Marg ERP offers best payroll software for her management system to manage large employee data, attendance management, & fast payroll processing, etc. Download free payroll software for trial or book free Demo @+364. Jul 16, 2020 Yes, Gusto, Payroll4Free.com, Xero, Zenefits, QuickBooks Payroll, and Patriot Software all offer payroll software that works for 1099 employees. Do payroll programs typically offer free trials? Most payroll software we looked at offer free trials. This software created by sumHR is a web-based payroll and HR management solution that can be used by growing companies to aggregate employee data, track leaves, monitor attendance and much more effectively.

- Payroll Software free. download full Version

- Payroll Software free. download full

- Payroll software, free download In Excel In India

Please note: You need to have version 20.0.0 or later of CheckMark Payroll already installed to run the latest patch.

Changes in Payroll 20.0.9 for 2020

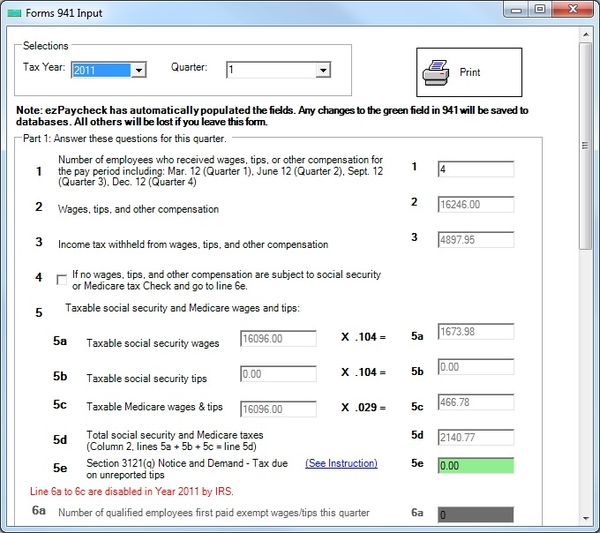

- Updated Form 941 for 3rd Quarter

Changes in Payroll 20.0.8 for 2020

PHP Payroll is a free employee attendance and payroll software specifically designed for medium and small enterprises. It is designed so that companies can improve the efficiency of their HR services such as automatic payment of salaries, employee attendance and leave management, generate salary slips, etc. CheckMark Payroll Simple payroll software that’s easy to use, accurate & secure. CheckMark MultiLedger Small business accounting software that's multi-user & cross-platform. CheckMark 1099 IRS Approved software to print & e-file unlimited 1099s with ease & accuracy.

- Fixed page 3 of the 941 form to auto fill the company name and FEIN #.

Changes in Payroll 20.0.7 for 2020

- New 941 form for 2nd Quarter 2020 with changes for COVID-19 reporting.

Changes in Payroll 20.0.6 for 2020

- Fixed AR State calculation issue.

- Updated Form 941 for 2020.

Changes in Payroll 20.0.5 for 2020

- Form 941 for 2020.

Changes in Payroll 20.0.4 for 2020

- Fixed federal tax calculation with 2020 W4 and additional federal withholding.

- CO and ND - Added 2019 tax tables for states that are allowing employees to choose either 2019 or 2020 tax withholding.

Note: 2019 tax tables allow employees to continue using allowances, while 2020 does not use allowances. - Added ND Head of Household tax table for 2020.

- Updated tax tables for AR.

- Fixed intermittent issues with accrued hours.

Changes in Payroll 20.0.3 for 2020

- Corrected federal tax calculation for employees who were setup on a 2020 W4 and claimed dependents on Step 3. When the check was created, the net was incorrect and a negative amount showed in federal withholding.

Changes in Payroll 20.0.2 for 2020

- Updated Federal taxes for 2020.

- State Tax Values Updated for ME, NJ, NM, VT, MA, RI .

- State Unemployment Maximums updated for NC, IL, AK, CO, ID, HI and RI.

- Mac Only - Rounding on Accrued Hours.

Changes in Payroll 20.0.1 for 2020

- Option to set a separate check number sequence for Employer Payments.

- Option to set employer match maximum (example- IRA cannot match more than employee contribution).

- Option to exclude exempt income from a match such as a 401k.

- Option to set % for direct deposits.

- Ability to have more than 5 employer payees in one payment.

- Ability to export/import Employer Payees.

- Federal taxes updated.

- Various State taxes and parameters are updated.

- Deduction parameters updated.

If you are an HR manager and want to manage the performance records and payroll details in the company, then it could be a tedious task. For this reason, you will be able to use certain Payroll Management Software. These Payroll Software or Recruiting Software will make managing aspect very easy as everything will be automated. Some Work Scheduling Software can be used for scheduling work to the employees automatically and these are free to use.

Related:

Payroll Software

This premium software created by Orange Technolab group of Companies is a payroll and HRM software that can be used to design and develop HR policies and improve the overall effectiveness by restructuring.

sumHR

This software created by sumHR is a web-based payroll and HR management solution that can be used by growing companies to aggregate employee data, track leaves, monitor attendance and much more effectively.

Paywings

This free software created by STPL Global can be used to process employee salary easily and has many features like biometric integration, mail alerts, call duty and overtime calculations and much more.

Marg Compusoft

IRIS

PenSoft

Zenefits

Saral PayPack

Paybooks

HR 2 Payroll

Pocket HCM

TalyPayroll

ZPay

BrightPay

Other File Transfer Software for Different Platforms

When you are using an operating system like Mac, Windows, Linux or Android, then you will want a file transfer software that will be able to work only on that particular operating system. There are much such software available online that can be used for this purpose.

Xero for Mac

This premium software can be used on the Mac platform to access certain areas of the payroll process easily. It has many time-saving tools for calculating taxes electronically and maintaining time sheets.

ExcelPayroll for Windows

This freeware can be used on the Windows platform to do any of the payroll processes. It is an Excel-based platform and can be used to generate accounting entries.

Payroll Software free. download full Version

Online Payroll for Android

This free Android app created by Intuit Inc can be used to create paychecks and e-pay taxes. The workers will be paid by direct deposits and timely reminders for upcoming paydays can be set.

QuickBooks – Most Popular Software

This premium software by Intuit Inc is very popular and can be used to manage accounting and payroll information easily. Salary can be calculated and pay slips can be generated along with bank statements.

Payroll Software free. download full

How to Install Payroll software?

Most of the Payroll Software that are available online will be premium versions. It is best to contact the manufacturer to get a demo of the software so that you will be able to understand all the features of it and use it properly. A trial version can be downloaded to make sure that it will be able to run on the system that is being used and then the premium version can be downloaded. The link can be used to download the file and the readme text can be read to check the system requirements. Then the software can be installed.

This software can be used for maintaining information like statutory compliances, bonus and arrear calculations. It is possible to print pay slips and arrears straight from the software and final settlement for the employees who quit can be done from all the data that is available in the software.

Payroll software, free download In Excel In India

Related Posts